Maryam Aminu

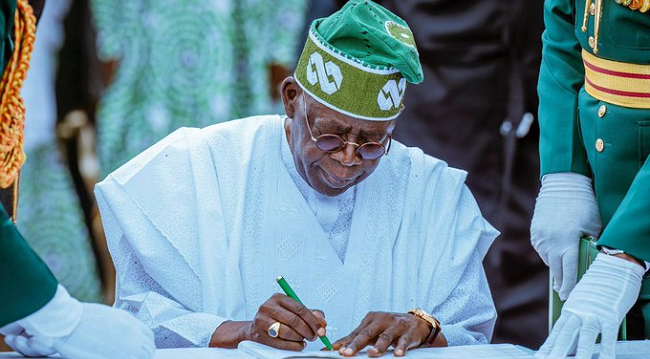

In a move described as a watershed moment for Nigeria’s fiscal transparency and revenue integrity, the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) has commended President Bola Ahmed Tinubu for signing an Executive Order directing the direct remittance of oil and gas revenues to the Federation Account.

The Chairman of Revenue Mobilisation Allocation and Fiscal Commission, M.B. Shehu, PhD, OFR, praised Bola Ahmed Tinubu for what he termed a bold and constitutionally grounded intervention aimed at eliminating revenue leakages and strengthening the financial base of the three tiers of government.

The Chairman of Revenue Mobilisation Allocation and Fiscal Commission, M.B. Shehu, PhD, OFR

According to the Commission, the Executive Order, signed pursuant to Section 5 of the 1999 Constitution (as amended) and anchored on Section 44(3), reinforces the constitutional principle that ownership, control and derivative rights over Nigeria’s minerals, mineral oils and natural gas are vested in the Government of the Federation for the collective benefit of all Nigerians.

RMAFC noted that prior to the Executive Order, certain structural and legal provisions within the Petroleum Industry Act created channels through which substantial Federation revenues were subjected to multiple deductions, including management fees, frontier exploration allocations and other layered charges. These deductions, the Commission said, significantly reduced net remittances to the Federation Account and constrained fiscal capacity at the federal, state and local government levels.

The Commission recalled that it had consistently advocated a review of statutory and regulatory provisions that enable frevenue leakage, erosion or retention outside the Federation Account.

It referenced its recent retreat held on February 9, 2026, in Enugu State, where concerns over structural revenue deductions were extensively discussed.

Describing the reform as timely and necessary, RMAFC said the Executive Order comes at a critical period marked by pressing national fiscal demands, including security, infrastructure development, education, healthcare delivery, energy transition and economic stabilisation.

By freeing revenues previously subjected to layered deductions and fragmented oversight, the Commission stated that the Executive Order enhances transparency, improves cash flow predictability, strengthens fiscal federalism and restores the constitutional revenue rights of the Federal, State and Local Governments.

Shehu emphasised that the reform significantly boosts the Commission’s capacity to discharge its constitutional mandate under Paragraph 32 of Part I of the Third Schedule to the Constitution, particularly in monitoring accruals to and disbursement of revenue from the Federation Account.

“With this Executive Order, the constitutional architecture of revenue remittance is strengthened. It closes structural leakages, eliminates duplicative deductions and ensures that revenues due to the Federation are remitted transparently. This directly supports the Commission’s oversight and monitoring responsibilities,” he stated.

RMAFC reiterated its full support for the Federal Government’s ongoing public financial management reforms and pledged continued collaboration with relevant institutions to ensure effective implementation of the Executive Order and safeguard the integrity of the Federation Account for the benefit of all Nigerians.